Thanks to our presenters at this months Finance Focus.

This month we looked at Employee Ownership Trusts with input from:

- Simon Warne, tax partner at Crowe on what is an Employee Ownership Trust (EOT) and the benefits

- Simon Carey, MD & Gemma Cox, HR Manager Barnwood Limited on their experience and journey so far

An Employee Ownership Trust is a way for business to be owned by its employees. An Employee Ownership Trust can be set up by the company’s current owners can be used:

- As an exit plan

- As a way to plan for succession

- Or it can be used as the model set up a business from the outset

The Employee Ownership Trust is a business ownership structure which was set up under the Finance Act 2014 to encourage companies to become employee-owned.

Watch Simon Warne’s Presentation:

Contact Details: Simon.Warne@crowe.co.uk

Download Simon’s slides:

Employee Ownership Trusts – Crowe

Employee Ownership Trusts – Crowe

Watch Simon Carey and Gemma Cox talk about their journey to becoming an EOT:

Then we heard from

- Drew Merritt & Emma Stevens, Corinthian Wealth Management creating your ideal future and how your employee benefits can help support this.

Contact Details: drew.marriott@sjpp.co.uk

Watch Drew’s presentation:

Further Resources

Tax-free sale to an Employee Ownership Trust

The business model of the future? by Simon Warne, Partner, Private Clients 23/03/2022

An EOT is a special form of employee benefit Trust which is set up to hold shares on behalf of all eligible employees of the company (usually employees who hold less than 5% of the company’s shares). Read full article from Simon Warne:

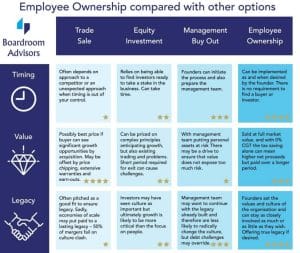

Employee Ownership Trust Compared to other Options. Snippet below access the full document: How-does-Employee-Ownership-compare-with-other-succession-options