The world has changed and has made many customers acutely aware of how employees are treated and how businesses affect their environment, and top talent cares about employers’ ESG reputation. Your people want to be part of something worthwhile, get behind something they believe in. It’s not enough to turn a profit your people and your customers want to know where your money is being invested and is it making a difference?

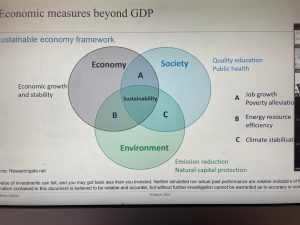

The roots of modern responsible investment can be traced to the 1960s and it has grown at an exceptional rate to where we are today, where it is estimated that almost half of all invested money in Europe is done with a responsible objective, according to the Global Sustainable Investment Alliance. ESG investment is one of the headline terms everyone in the investment industry and beyond is seeing every day. ESG stands for ‘Environmental, Social and Governance’ and is a way of describing the factors that are used alongside traditional financial considerations when making investment decisions.

Janet Mui, Head of Market Analysis at Brewin Dolphin gave us an overview of the current markets and the growing trend toward ESG investments.

What are Brewin Dolphin doing Internally? A statement from their CEO Robin Beer:

Our commitment to sustainability and responsible investment has never been greater. As a business we have always had a deep sense

of doing what is right for our clients, and right for our communities. It is an important part of who we are and what we do.

Our purpose is to enrich the lives of our clients by inspiring confidence in the future, so they can make the choices needed to achieve their life ambitions. We always seek to have a positive impact on society, our people, clients and the environment.

All our initiatives and ambitions are about supporting and safeguarding our stakeholders’ interests, whilst ensuring we build a strong corporate foundation for a sustainable future. When I became CEO in 2020, I set Environmental, Social, Governance (‘ESG’)

as one of my top priorities. We held a Group-wide review, sponsored by our Board and managed by our Executive Committee (‘ExCo’). As a result, we created a Sustainability team, a Sustainability Committee and an ESG investment forum.

Together, they created our Sustainability Framework: Responsible Business, Responsible Investment and Stewardship. This has been integrated in to our governance framework.

Responsible Investment is one of the three pillars of sustainability at Brewin Dolphin.

We are a proud signatory of the UN’s Principles of Responsible Investment and we believe that the combination of ESG integration in the investment process and good stewardship are the basis of responsible investment. We define responsible investment as a strategy and practice to incorporate environmental, social and governance factors in investment decisions and active ownership.” Integrating ESG in to our investment process.

As a signatory of the UN PRI, we believe that the combination of ESG integration and good stewardship are the basis of responsible investment. We have a spectrum of different approaches and each approach has a determined objective and varying degree of impact.

ESG integration, which consists of considering environmental, social and governance factors, is central to our investment research process. We believe that high quality companies who manage ESG risks and opportunities well will make attractive long-term investments.

Our research team considers ESG factors when evaluating individual companies and when they assess fund managers. Through the use of Sustainalytics, a third-party provider of ESG data, material risks and opportunities are fed into traditional financial analysis and models for our ‘buy list’ stocks. They evaluate ESG risks and opportunities for every fund and stock they assess to ensure they are aligned with our

sustainable long-term growth goals. More details on our approach can be found in our Responsible Investment Statement which is available on our website: https://www.brewin.co.uk/sites/brewin-corp-v2/files/reports-and-presentations/esg/sustainability-report-2021-v1.pdf