November marks the third month in a row during which prices have fallen with potential buyers playing safe by delaying purchases.

The average UK house price in November was £285,579.

Higher mortgage rates, economic uncertainty, and the rising cost of living are all affecting the market.

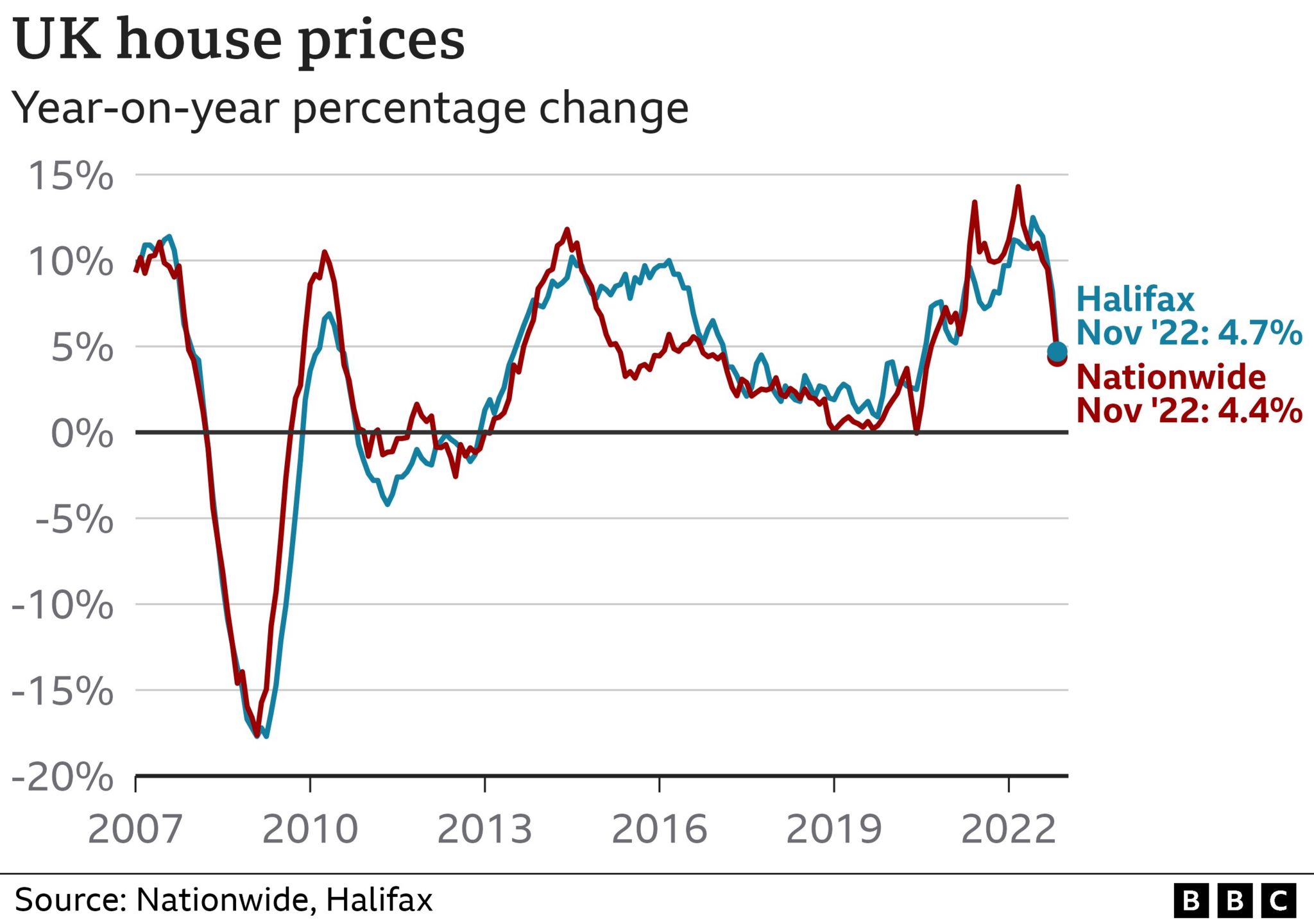

The annual rate of growth in property prices has now dropped from 8.2% to 4.7%.

Kim Kinnaird, director of Halifax Mortgages, said: “While a market slowdown was expected given the known economic headwinds – and following such extensive house price inflation over the last few years, this month’s fall reflects the worst of the market volatility over recent months.

“Some potential home moves have been paused as homebuyers feel increased pressure on affordability and industry data continues to suggest that many buyers and sellers are taking stock while the market continues to stabilise.”

However, she said that the falls should be put into context, given the rapid increase in property prices in the last few years.

Property prices were up more than £12,000 compared with this time last year, and £46,403 higher than in March 2020 when the Covid pandemic began.

The Halifax said Wales and the South West of England had recorded particularly sharp slowdowns in annual house price growth.

Both had been at the forefront of house price inflation during the pandemic, when the so-called race for space among buyers boosted demand for rural or coastal properties.

The Halifax survey, based on the lender’s own data, comes shortly after the rival Nationwide Building Society said prices fell 1.4% from October to November – the largest month-on-month fall since June 2020.

Mortgage rates are much higher than at any time during the last decade, although earlier this week, the average rate on a new, fixed-rate two or five-year deal fell below 6% for the first time for two months.

Tomer Aboody, director of property lender MT Finance, said: “With another fall in property prices in November, buyers and sellers are clearly demonstrating more caution due to higher mortgage rates and the ever-rising cost of living.

“As with any fall in pricing, buyer sentiment and confidence is key. But considering the macro-economic and seasonal factors affecting all consumers, along with the month-on-month increases seen over the past 18 months or so, the decline needs to be put into context as it is still minimal.”