How are rising costs affecting businesses?

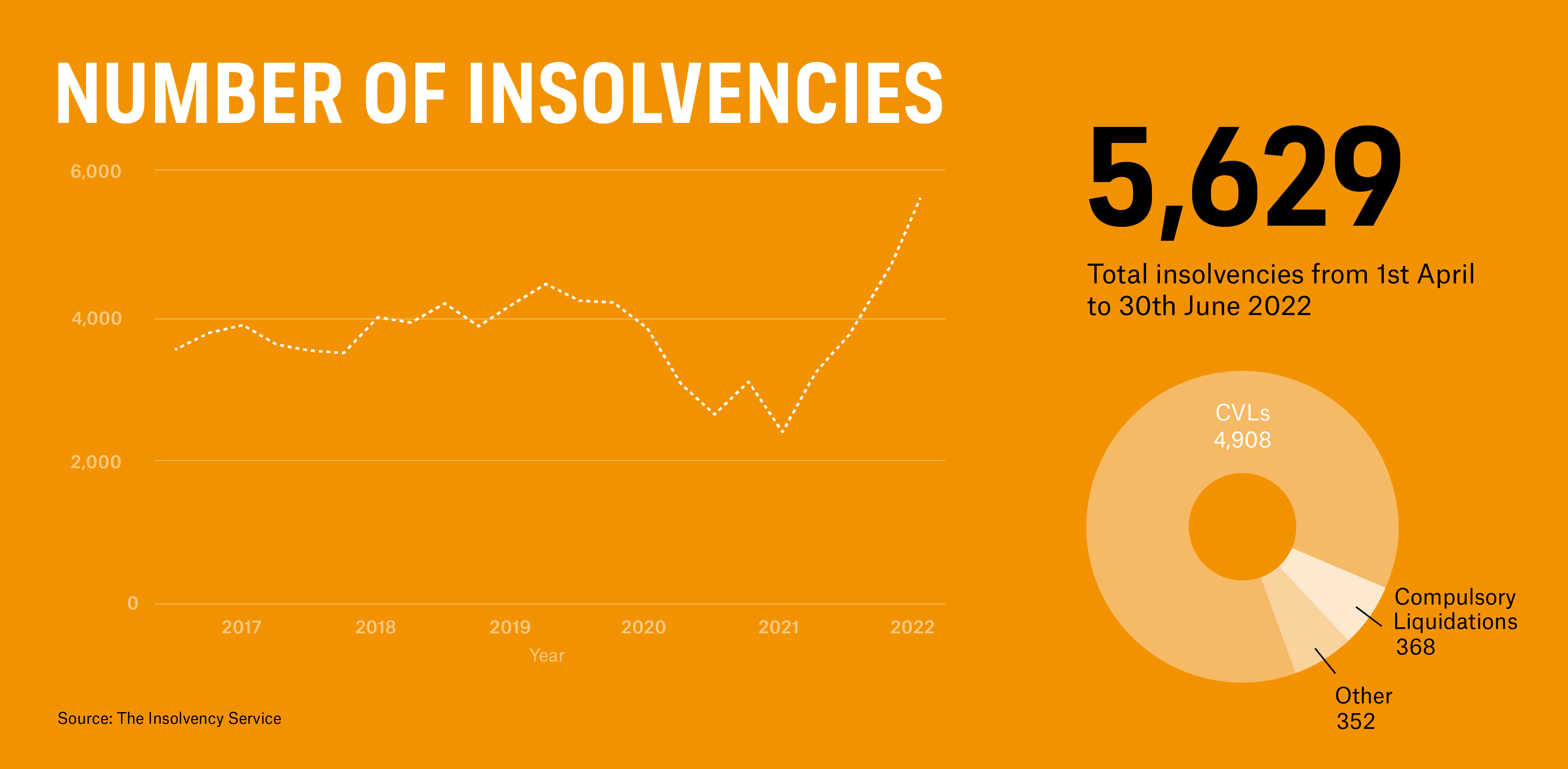

With rising inflation, higher labour and material costs, and the withdrawal of COVID-19 support schemes, many businesses are struggling to stay afloat. During the second quarter of 2022 corporate insolvencies in England and Wales jumped to 5,629, a 13% increase on the Q1 2022 statistic, and a worrying 81% increase compared to Q2 2021 when the COVID-19 support measures and restrictions on court action to pursue debts were still in place.

Furthermore, 1 in 228 active companies (at a rate of 43.9 per 10,000 active companies) entered liquidation between 1 July 2021 and 30 June 2022, an increase from the 26.1 per 10,000 active companies that entered liquidation in the 12 months ending 30 June 2021.

The insolvency service figures for the last three quarters indicate that the Government support measures postponed a rise in levels of corporate insolvency rather than preventing them.

Are corporate insolvency rates likely to increase further?

While the insolvency statistics are backward looking, the ‘Red Flag Alert’ research published by Begbies Traynor Group looks forward by looking at the number of companies currently in financial distress.

The latest report, released at the beginning of August, shows an increase of 37% in the number of companies in ‘critical financial distress’ compared to the same period a year earlier. County Court Judgements (an early warning sign of future insolvencies) were up by 5% against the first quarter of 2022, with the number of CCJs ruled within the first 6 months of 2022 fast approaching the total for the whole of 2021. In addition, it is reported that over 582,000 businesses are in significant financial distress, remaining flat on the previous quarter.

All this leads Julie Palmer, partner at Begbies Traynor, to warn that “With this latest research showing almost 600,000 companies in significant financial distress, we would expect the weakest to enter insolvency over the next two years.”

What impact is this having on the Credit insurance market?

With the number of insolvencies relentlessly climbing, the market saw an increase in demand for Trade Credit insurance in Q1 and Q2 which we believe will continue into Q3. With rising inflation, higher labour and material costs, and the withdrawal of COVID-19 support schemes, businesses are becoming increasingly concerned about their trade credit risk.

During previous economic downturns, we have seen insurers become more selective about which new enquiries they are prepared to consider. For now, all our Credit insurance partners have been keen to stress in recent meetings that the quality of their information gathering, and analysis allows them to continue to offer support for all interested businesses in the UK. However, our advice to any company considering credit insurance is to act quickly in seeking advice from a specialist insurance broker to ensure your business is appropriately protected.

Contact The Channel Partnership if you have any queries related to the information covered in this post. And, for more tips on how to manage your business’s trade credit risk, you may find this blog useful.