We have spent a lot of time this week unpicking and looking at the support coming out from government for businesses. With Partners Crowe, Chris Mould and Nick Latimer and valuable input from other experts we have updated members on the current state of play and the opportunities available in these very uncertain times. Thanks to Bob Holt OBE for joining each day to share his insights.

Everyone is welcome to attend these events and share knowledge and learn what is going on. Every Thursday @4pm on-line. Book in the usual way on the C2S website: https://www.circle2success.com/events/

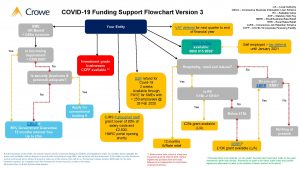

This flow diagram helps to explain what is available and to who:

* Extra protection for businesses with ban on evictions for commercial tenants who miss rent payments.

* Financial assistance for employers unable to pay statutory redundancy payments

* The Coronavirus Job Retention Scheme

* Deferring VAT and Income Tax payments

* Statutory Sick Pay relief package for SMEs

* 12-month business rates holiday for all retail, hospitality, leisure and nursery businesses in England

* Small business grant funding of £10,000 for all business in receipt of small business rate relief or rural rate relief

* Grant funding of £25,000 for retail, hospitality and leisure businesses with property with a rateable value between £15,000 and £51,000

* The Coronavirus Business Interruption Loan Scheme offering loans of up to £5million for SMEs through the British Business Bank

* A new lending facility from the Bank of England to help support liquidity among larger firms, helping them bridge coronavirus disruption to their cash flows through loans: * The HMRC Time To Pay Scheme

Latest government advice: https://www.gov.uk/government/publications/guidance-to-employers-and-businesses-about-covid-19/covid-19-support-for-businesses#support-for-businesses-through-the-coronavirus-business-interruption-loan-scheme

Some HMRC VAT updates discussed:

- Any VAT payments due after the 20th March 2020 and before 30th June 2020 can be deferred

- HMRC are currently unclear how payments collected by direct debit will be effected, they have advised us to continue checking the website which will be updated when further information becomes available. If you currently pay by direct debit you may wish to cancel the mandate as soon as you are able to ensure payment is not taken, a new agreement can be set up again at any time.

- No interest will be charged on deferred payments due before 30th June

- This is an automatic offer with no applications required

- All UK businesses are eligible – with no exception that we are aware of

- Taxpayers will be given until the end of the 2020 to 2021 tax year to pay any liabilities that have accumulated during the deferral period – this means you have until 5th April 2021 to make settlement

- VAT refunds and reclaims will be paid by the government as normal.

- VAT returns must still be filed on time, please continue to get all your paperwork together and to us in a timely manner to allow us to submit your returns.

These are really useful sessions to clarify issues and concerns. Please join us for the next ones, book on the website in the usual way: https://www.circle2success.com/events/

Contact Crowe for more information on how they can support you: chris.mould@crowe.co.uk